In June 2019 the OECD expanded the functionality of the MLI. To qualify for the HR Block Maximum Refund Guarantee the refund claim must be made during the calendar year in which the return was prepared and the larger refund or smaller tax liability must not be due to incomplete inaccurate or inconsistent information supplied by you positions taken by you your choice not to claim a deduction or.

What Is Tax Residence And Why Does It Matter

Read more are bifurcated into seven brackets based on their taxable income.

. Marginal Tax Rate US. A top executive at former President Donald Trumps family business pleaded guilty Thursday to evading taxes on a free apartment and other perks striking a deal with prosecutors that could make him a star witness against the company at a trial this fall. Tax Evasion Reporting Form.

Overview and Quick Guides. The Income Tax Ordinance 2001. Al Mawarid Bank was one of many in the country that restricted customers US.

Professor Joosung Jun argues that for countries with large informal sectors and tax evasion pressures tax incentives can be a means of enhancing productivity and economic grow by preventing firms from shifting into the informal sector or evasion-prone activities. It is a limited-time opportunity for a specified group of taxpayers to pay a defined amount in exchange for forgiveness of a tax liability including interest penalties and criminal prosecution relating to previous tax periods. Allen Weisselberg a senior Trump Organization adviser and formerly the companys longtime chief financial officer.

Malaysia is not on the FATF List of Countries that have been identified as having strategic AML deficiencies. Bangladesh authorities have found many cases of tax evasion by Beijing-based companies or their subsidiaries in Dhaka Bangladesh live news reported. Breach of confidence 118.

It typically expires when some authority. Falling global oil prices in the second half of 2014 have strained. Only tax evasion cases of particular seriousness defined as a minimum of 50000 in unpaid tax do not expire under a 10-year statute of limitations in Germany.

Obstruction of officers 117. Bangladesh is one such country that seems to have suffered from the unethical behaviour of the Chimese companies. Dollar withdrawals to stem economic panic.

The Income Tax Ordinance was the first law on Income Tax which was promulgated in Pakistan from 28 June 1979 by the Government of Pakistan. In a recent example a case involving a Chinese company in tax evasion came to light. Reductions in energy and sugar subsidies and the announcement of the 2015 implementation of a 6 goods and services tax.

There is tax evasion and the government needs to address that Kheireddine said. Investment incentives have contributed to the rapid economic growth of countries. Tax avoidance lowers your tax bill by structuring your transactions so that you reap the largest tax benefits.

Some of the major tax incentives available in Malaysia are the Pioneer Status PS Investment Tax Allowance ITA and Reinvestment Allowance RA. 1 Australias income tax treaties are given the force of law by the International Tax Agreements Act 1953The Agreement between the Australian Commerce and Industry Office and the Taipei Economic and Cultural Office concerning the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to Taxes on Income is a document of less than treaty status. Although they sound similar tax avoidance and tax evasion are radically different.

Into Double Tax Treaties to elim inate or mitigate the incidence of juridical double taxation and avoidance of fiscal evasion in the international trade or transactions. Tax evasion and briberycorruption. Data and research on tax treaties including OECD Model Tax Convention Mutual Agreement Procedure Statistics prevention of treaty abuse The MLI Matching Database makes projections on how the MLI modifies a specific tax treaty covered by the MLI by matching information from Signatories MLI Positions.

Different types of tax incentives offered in Malaysia in the form of tax exemptions allowances related to capital expenditure and enhanced tax deductions. Mac Jones heads to X-ray room doesnt speak to media due to back injury. LAWS OF MALAYSIA Act 53 INCOME TAX ACT 1967 ARRANGEMENT OF SECTIONS PART I PRELIMINARY Section 1.

That same year the Pandora Papers reveal Kheireddine signed documents as owner of a BVI company that owns a 2 million yacht. The kingdom of Saudi Arabia and the Republic of Albania for the avoidance of double taxation and the prevention of tax evasion respect to taxes on income and on capital signed on 622019 and entered into force on 1122019. Short title and commencement 2.

Offences by officials 119. Leaving Malaysia without payment of tax 116. Tax evasion on the other hand is an attempt to reduce your tax liability by deceit.

Allen Weisselberg longtime Trump Organization CFO pleads guilty to tax evasion 8182022. For instance a manufacturing company with a pioneer status tax incentive pays an effective tax at the rate of 72 as only 30 of its profits are subject to tax. To update the tax laws and bring the countrys tax laws into line with international standards the Income Tax Ordinance 2001 was promulgated on 13 September 2001.

Tax avoidance is completely legaland extremely wise. Data and research on tax including income tax consumption tax dispute resolution tax avoidance BEPS tax havens fiscal federalism tax administration tax treaties and transfer pricing. Access to e-Services.

Tax amnesty allows taxpayers to voluntarily disclose and pay tax owing in exchange for avoiding tax evasion penalties. In the US taxpayers Taxpayers A taxpayer is a person or a corporation who has to pay tax to the government based on their income and in the technical sense they are liable for or subject to or obligated to pay tax to the government based on the countrys tax laws.

Investigating And Applying Measures To Prevent The Evasion Of Trade Remedies On Cane Sugar Products Investigations How To Apply Prevention

Pdf Causes Of Tax Evasion And Their Relative Contribution In Malaysia An Artificialneural Network Method Analysis Semantic Scholar

Common Reporting Standards Impact In Malaysia And Asean Asia Law Portal Retirement Fund Financial Information Financial Institutions

Traditional Lanterns Display During Chinese New Year Festival At Thean Hou Temple Kuala Lumpur Kuala Lumpur One Day Trip Cool Places To Visit

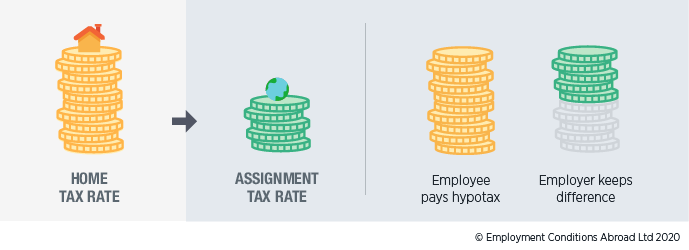

Mobility Basics What Are Tax Equalisation And Tax Protection Eca International

Pdf Causes Of Tax Evasion And Their Relative Contribution In Malaysia An Artificialneural Network Method Analysis Semantic Scholar

Aml Guidance About Tax Evasion For Organizations Sanction Scanner

Gst Registration Pan India Registration Goods And Service Tax Goods And Services Registration

Tax Havens Around The World Tax Haven Offshore Bank Offshore

Some Of The Best Methods To Prevent Tax Evasion Enterslice

Differences Between Tax Evasion Tax Avoidance And Tax Planning

The Pandora Papers Show The Line Between Tax Avoidance And Tax Evasion Has Become So Blurred We Need To Act Against Both

7 Steps Process To Create Kickass Headlines Social Media Marketing Business Power Of Social Media Social Media Jobs

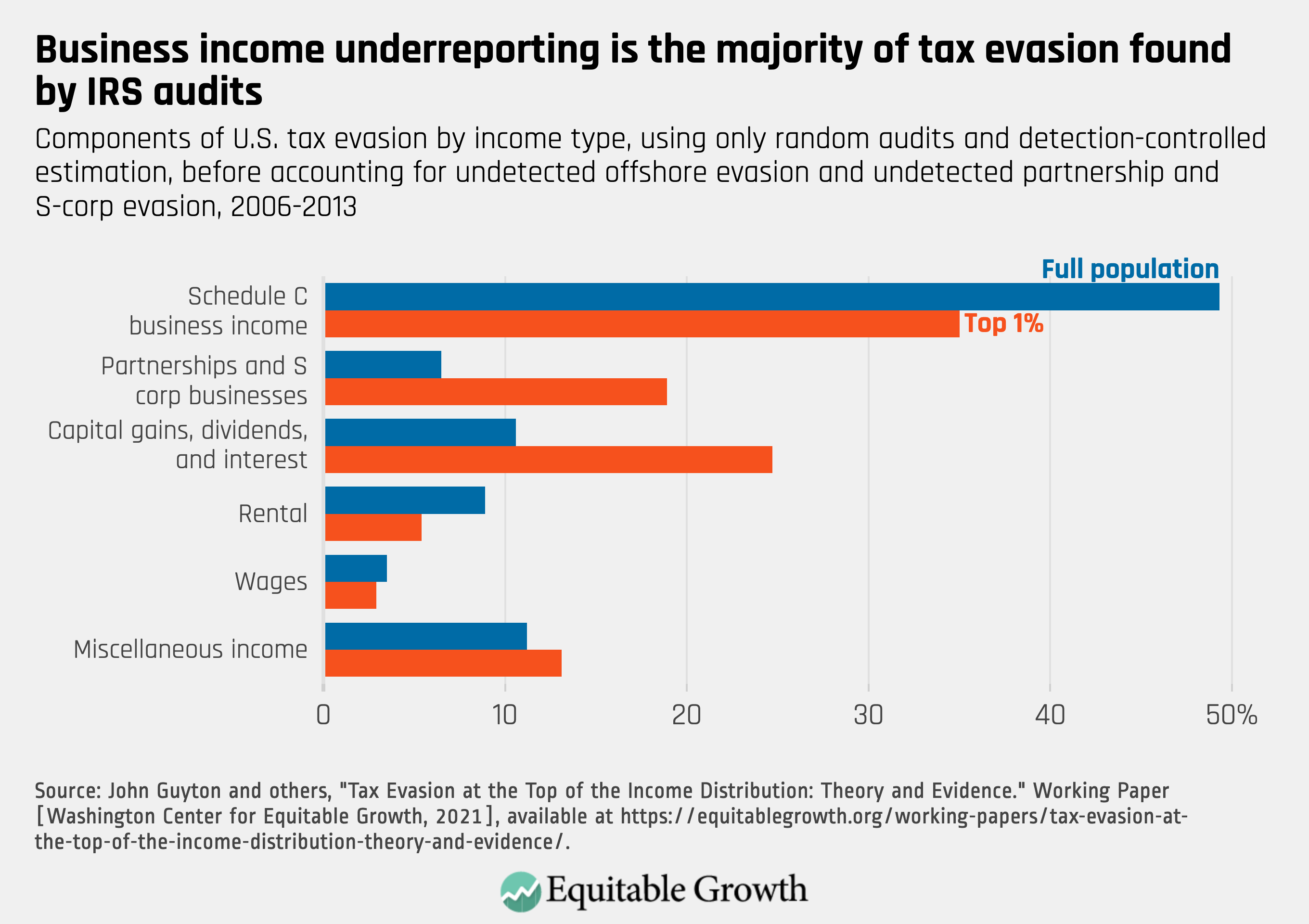

The Sources And Size Of Tax Evasion In The United States Equitable Growth

Seeing Number Of Gst Notices To Collect Outstanding Gst Directly From Bank Accounts Applies To Ecomm Operators Accounting Tax Services Accounting Software

Pdf Causes Of Tax Evasion And Their Relative Contribution In Malaysia An Artificialneural Network Method Analysis Semantic Scholar